Day Trading Made Easy: How to Use MACD Like a Pro

Click Here To Save Time

Time Saver

MACD is a key momentum indicator that helps day traders spot potential buying or selling opportunities.

MACD Line, Signal Line, and Histogram are the core parts of the MACD, each serving a unique purpose in analyzing stock trends.

A bullish or bearish crossover between the MACD Line and Signal Line can indicate the right time to buy or sell.

Watching for divergence between MACD and stock price can signal an upcoming trend reversal.

The MACD crossing above or below the zero line indicates shifts in market momentum.

Combining MACD with other indicators like RSI or support/resistance levels can improve trade accuracy.

Introduction

Imagine you’re at the starting line of a race, where each runner symbolizes a different stock in the market. Some stocks dash ahead, some fall behind, and others struggle to find their rhythm.

As a day trader or swing trader, your goal is to pick the stock that will surge ahead. But how do you make the right choice? This is where technical analysis indicators like the MACD (Moving Average Convergence Divergence) come in handy.

Think of MACD as a wise coach on the sidelines, offering insights into which stocks are gaining momentum and which are losing it. In the fast-paced world of day trading, where every second counts, MACD can be a crucial tool for spotting potential trading opportunities and making informed decisions.

This guide will explore MACD, explaining what it is, how it works, and how you can apply it to your day trading strategy. We’ll use real-world examples, dive into case studies, and share personal stories to make the concept clear. By the end of this article, you’ll understand MACD and how to use it effectively in your trading efforts.

What is MACD?

Let’s start by understanding what MACD is. At its core, MACD is a momentum indicator that helps traders follow trends by showing the relationship between two moving averages of a stock’s price. It’s like having a dual perspective on the market—one view capturing the broader trend and the other focusing on recent movements.

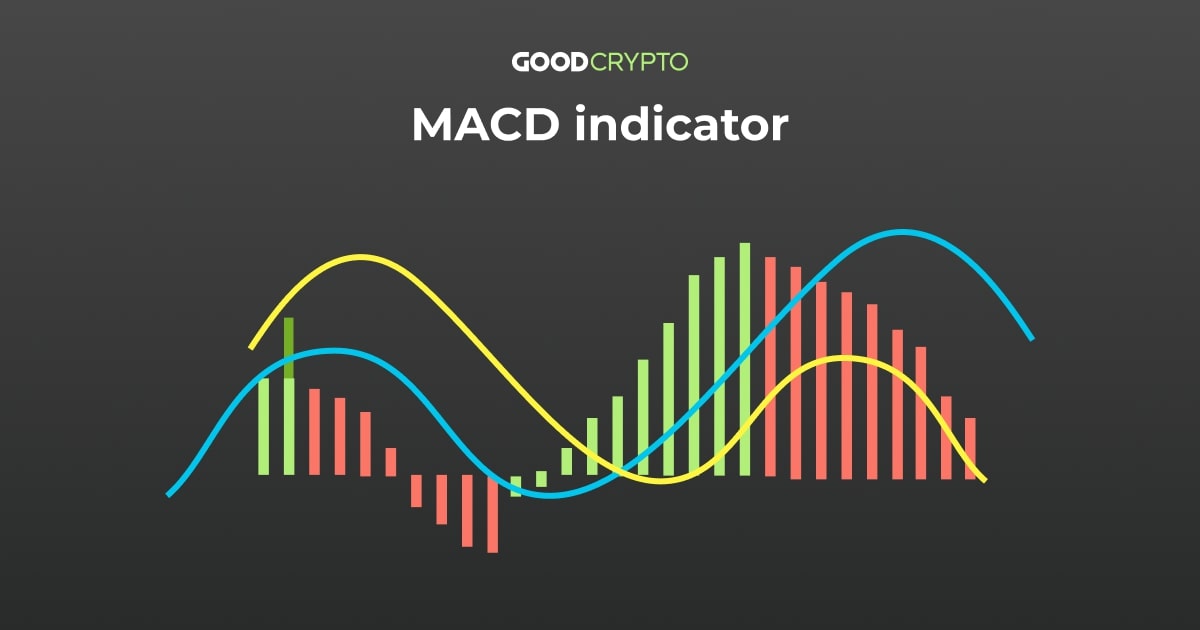

MACD consists of three main components:

1. MACD Line: This is calculated by subtracting the 26-day Exponential Moving Average (EMA) from the 12-day EMA. It shows the short-term momentum of the stock.

2. Signal Line: A 9-day EMA of the MACD Line, this line smooths out the MACD’s movements, making trends easier to spot.

3. Histogram: This is a visual representation of the difference between the MACD Line and the Signal Line. It fluctuates above and below the zero line, helping traders understand the strength and direction of momentum.

Understanding MACD in Day Trading

Imagine you’re a day trader named Sarah. Each morning, Sarah sits down with her coffee, ready to start trading. She pulls up the chart of a stock she’s been watching. The first thing she checks? The MACD.

For Sarah, the MACD isn’t just lines and bars—it’s a story that helps her predict the stock’s next move.

Here’s how she reads it:

1. The Crossover: When the MACD Line crosses above the Signal Line, it’s a bullish sign—like a green light telling Sarah it’s time to buy.

When the MACD Line crosses below the Signal Line, it’s a bearish signal, suggesting it might be time to sell.

2. Divergence: If the stock price moves in one direction, but the MACD moves in the opposite, it often means the current trend is weakening. Sarah knows this could signal a reversal, so she watches for it closely.

3. The Zero Line: The MACD oscillates around the zero line. A cross above the zero line indicates bullish momentum, while a cross below suggests bearish momentum. This line helps Sarah gauge the overall trend.

Case Study: MACD in Action

Let’s look at how MACD can be applied in real trading. Meet John, a day trader with a few years of experience. One day, John notices a stock that’s been moving sideways for a while—it’s in a consolidation phase. After such periods, stocks often break out into strong trends. But which way will it go?

John checks the MACD and sees that the MACD Line has just crossed above the Signal Line, a bullish sign. The histogram, which was below the zero line, is now creeping up. Sensing an opportunity, John buys the stock.

As the day progresses, the MACD Line continues to rise above the Signal Line, confirming the bullish trend. By the end of the day, the stock has surged, and John closes his trade with a profit. The MACD gave him the confidence to make his move.

Advanced Strategies with MACD

While basic MACD signals are useful, experienced traders like Sarah and John often use advanced strategies to fine-tune their trades.

1. MACD and RSI Combo: Combining MACD with the Relative Strength Index (RSI) can give stronger signals. For example, if the MACD shows a bullish crossover and the RSI moves out of the oversold zone, it’s a strong sign that an uptrend might be starting.

2. MACD and Support/Resistance Levels: Another strategy involves using MACD alongside key support or resistance levels. A MACD crossover near these levels can signal a strong move. Sarah often waits for a MACD crossover near a support level, which usually indicates a high-probability trade.

3. MACD Divergence and Volume Analysis: Volume is crucial in trading. When combined with MACD divergence, it can signal a trend reversal.

If Sarah spots a bearish MACD divergence and declining volume, she might prepare to short the stock, expecting a downturn.

Personal Experience: Lessons Learned

Sarah’s journey with MACD wasn’t always smooth. Early on, she relied too heavily on MACD crossovers without considering the broader market context. Once, she bought a stock right after a bullish crossover, only to see it plummet because she ignored the overall market downtrend.

This taught Sarah a valuable lesson: MACD should be part of a broader strategy, not used in isolation. She learned to consider market conditions, support and resistance levels, and other indicators before making trades. It was a tough lesson, but it made her a better trader.

Common Pitfalls with MACD

Despite its power, MACD has pitfalls. One common mistake is using MACD in a sideways market. In such conditions, MACD can give many false signals, leading to whipsaws—where traders are repeatedly stopped out of trades.

Another pitfall is relying too much on MACD crossovers without considering other factors. While crossovers can be effective, they aren’t foolproof. The stock market is influenced by many variables, and no single indicator can capture them all.

Lastly, traders should remember that MACD is a lagging indicator. Since it’s based on moving averages, signals often come after a move has started, which can lead to late entries and missed opportunities. To avoid this, many traders use MACD with other leading indicators.

Conclusion: The Role of MACD in Day Trading

MACD is like a compass in the turbulent world of day trading. It helps you navigate the noise and focus on the signals that matter. Whether you’re a beginner or an experienced trader, understanding and using MACD can greatly improve your trading strategy.

However, its effectiveness depends on how you use it. By combining MACD with other indicators, understanding its limitations, and learning from your experiences, you can make it a valuable tool in your day trading arsenal.

So, next time you’re ready to trade, remember the lessons from Sarah and John. Let the MACD guide you, but always stay in control. In day trading, informed and disciplined traders win the race.

Click Here For Our Sources

Sources

www.investopedia.com/terms/m/macd.asp

www.tradingview.com/ideas/macd/

www.stockcharts.com/school/doku.php?id=chart_school:technical_indicators:macd-histogram

Leave a Reply

You must be logged in to post a comment.